Table Of Content

In a shared building, the HOA might take care of most maintenance. Homeowners insurance costs more in places where homeowners file more claims. A local insurance agent might be happy to give you an idea about prices in the area since you could become a future client. If you just want to ballpark it, the national average annual premium for a $250,000 home is about $1,100 (about $92/month).

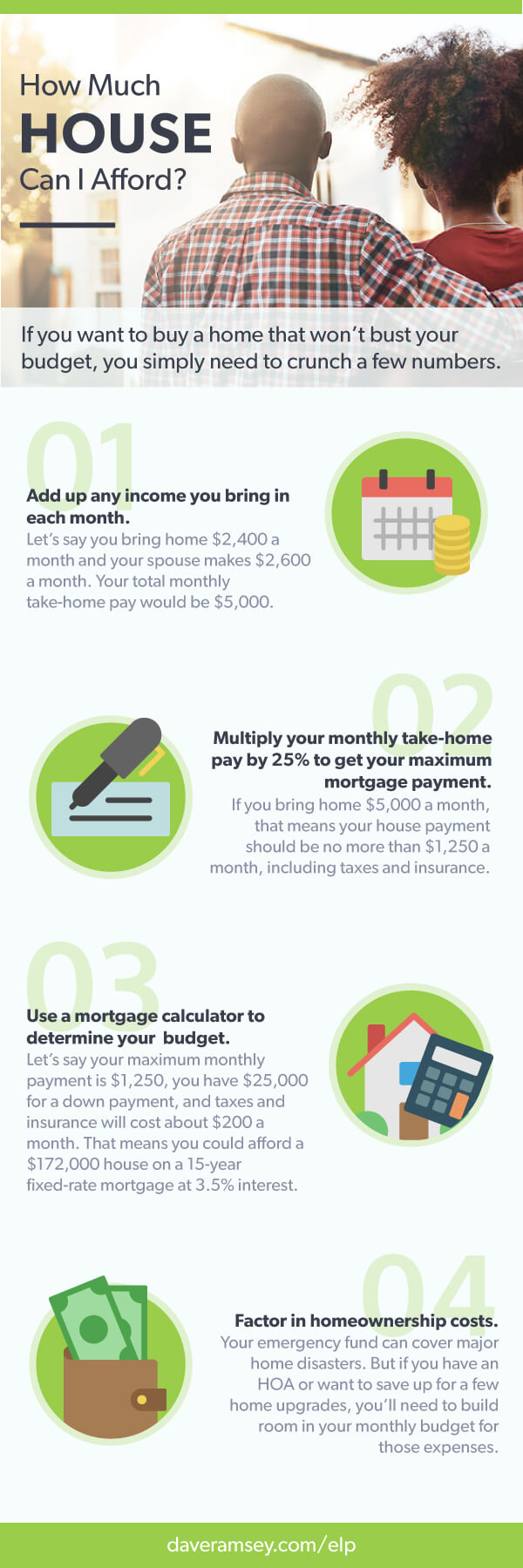

Income

That’s why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment (which of course translates into a smaller loan). The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan. Plugging all of these relevant numbers into a home affordability calculator (like the one above) can help you determine the answer to how much home you can reasonably afford.

How much money will be required at closing?

Plus, you may have trouble maintaining your other financial obligations, including building up your emergency fund and saving for retirement. If you pay less than 20% of the sales price, you will have to pay PMI as part of your monthly repayments. It’s a good idea to have at least $3,000 to $10,000 saved up to cover these costs or unexpected expenses along the way. There are no set rules regarding how much of your income should cover a mortgage payment. However, lenders will look at how much of your income is going to other outstanding debts before approving another loan.

Fixed rate vs adjustable rate

While maintaining a debt-to-income ratio under 36% protects you from minor changes in your finances, a cash reserve protects against major ones. Banks don’t like to lend to borrowers who have a low margin of error. That’s why your pre-existing debt will affect how much home you qualify for when it comes to securing a mortgage. You might not want to borrow the maximum amount a lender offers you. Lenders don’t have a complete picture of your financial situation, despite all the paperwork they ask for.

This loan type is specifically designed for families looking to buy homes in rural areas. Similar to the FHA loan, this home loan lets lower-income families become homeowners. The loan does not require a down payment, but you will have to get private mortgage insurance. If lenders determine you are mortgage-worthy, they will then price your loan.

Both the upfront fee and the annual fee will detract from how much home you can afford. Loans, grants, and gifts are three ways to supplement your savings for a down payment. Use the home affordability calculator to help you estimate how much home you can afford. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

If you want to shrink your debt-to-income ratio before applying for a mortgage — which is likely a good idea — pay off your credit cards and other recurring debts, like student loans and car payments. The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results.

You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments. Your reserve could cover your mortgage payments - plus insurance and property tax - if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. Homeownership comes with unexpected events and costs (roof repair, basement flooding, you name it!), so keeping some cash on hand will help keep you out of trouble. This can mean private mortgage insurance (PMI), which is an added monthly charge to secure your loan.

Mortgage Calculator

How Much House Can I Afford On A $120K Salary? - Bankrate.com

How Much House Can I Afford On A $120K Salary?.

Posted: Tue, 03 Oct 2023 07:00:00 GMT [source]

Let's take a look at a few hypothetical homebuyers and houses to see who can afford what. A financial advisor can aid you in planning for the purchase of a home. To find a financial advisor who serves your area, try SmartAsset's free online matching tool.

FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. Estimate your monthly payments, closing costs, APR and mortgage interest rate today.

Just enter your location, yearly income, monthly debts and how much money you have for a down payment and closing costs. The calculator will take this information and tell you how big of a loan you can safely take on. The calculator doesn’t display your debt-to-income (DTI) ratio, but lenders care a lot about this number. They don’t want you to be overextended and unable to make your mortgage payments.

No comments:

Post a Comment